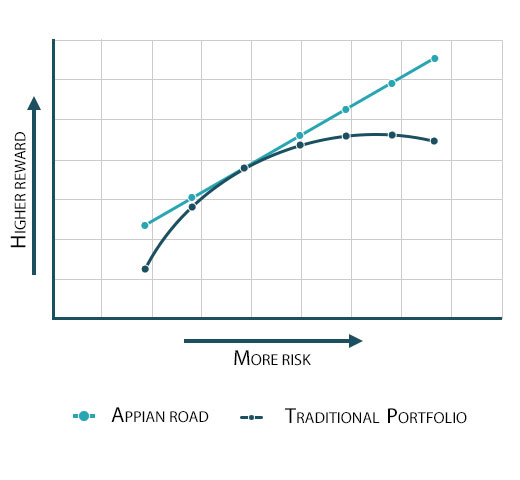

Returns from traditional wealth managers are based off the

ARC Private

Client Indices

which provide historical performance for discretionary private clients by participating investment managers (learn more about

ARC Methodology here). The Appian Road portfolio is composed of the factors and ETFs found later on this page. The data is sourced from Bloomberg total return indices. For simplicity, both of these portfolios assume all dividends are reinvested and have consistent weights (i.e. never rebalanced). The Appian Road portfolio and those of traditional wealth managers are net of management fees while S&P 500 assumes no management fees. Please note that simulations may not be up-to-date to the current month.